Texas Homestead Exemption For 2024. Houston texas buy a home sell a home. This requirement may be waived if you are:

A resident of a facility that provides services related to health, infirmity, or aging; Homeowners across the state are set to benefit from an increase in their homestead exemption from $40,000 to $100,000 of their home’s assessed value.

The Process May Seem Daunting At First, But With The Right Information And Documentation, It Can Be A Straightforward And Rewarding Experience.

Applying for a homestead exemption in texas can be a beneficial step towards reducing your property taxes and protecting your primary residence.

1751 Enterprise Athens, Tx 75751.

Houston texas buy a home sell a home.

Are You Transferring An Exemption From A.

Images References :

Source: yourrealtorforlifervictoriapeterson.com

Source: yourrealtorforlifervictoriapeterson.com

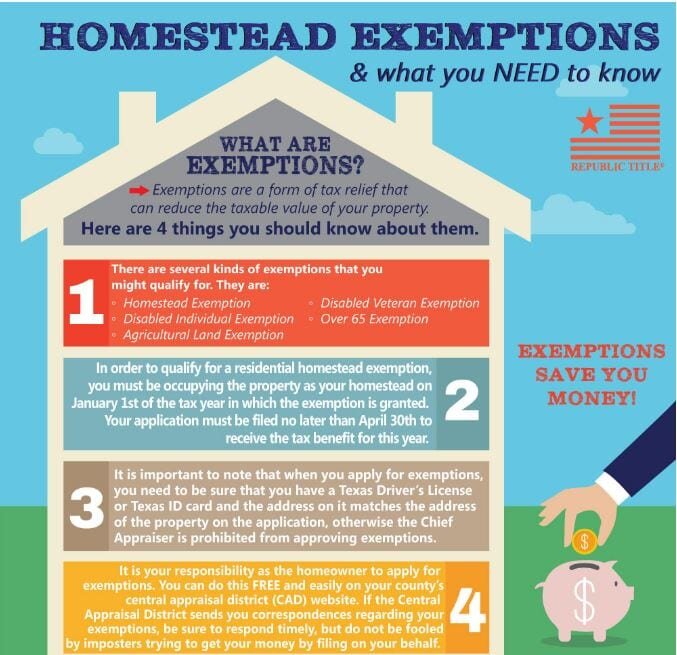

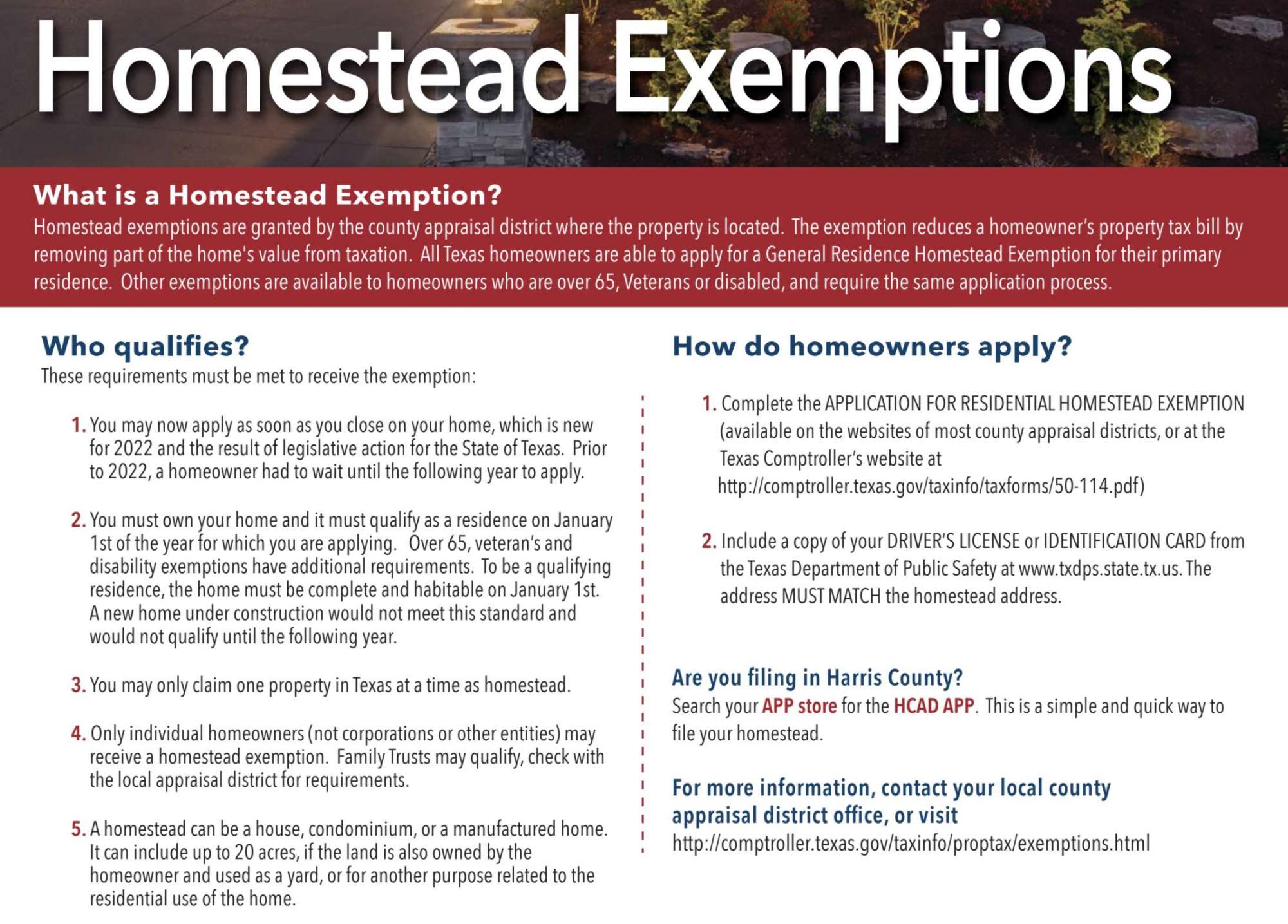

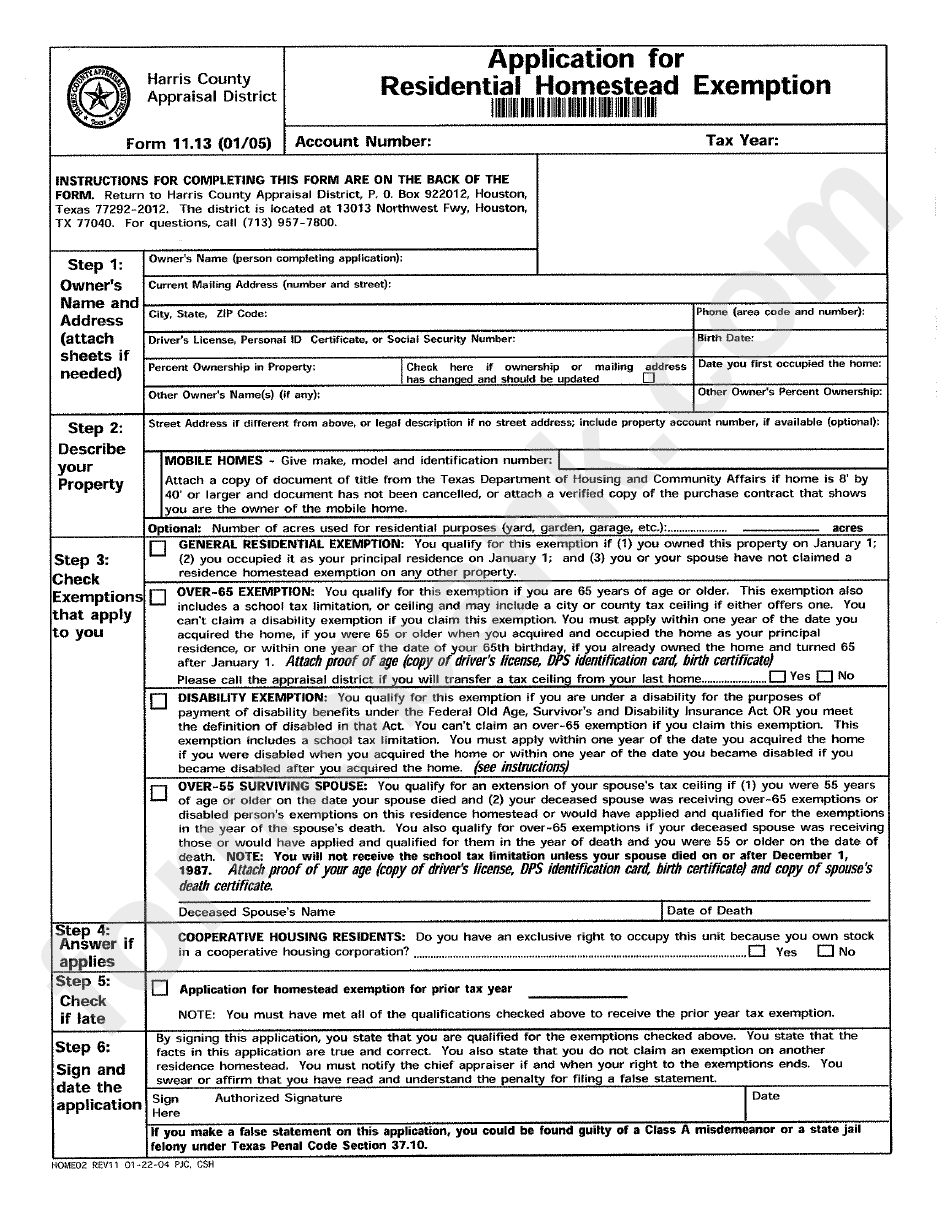

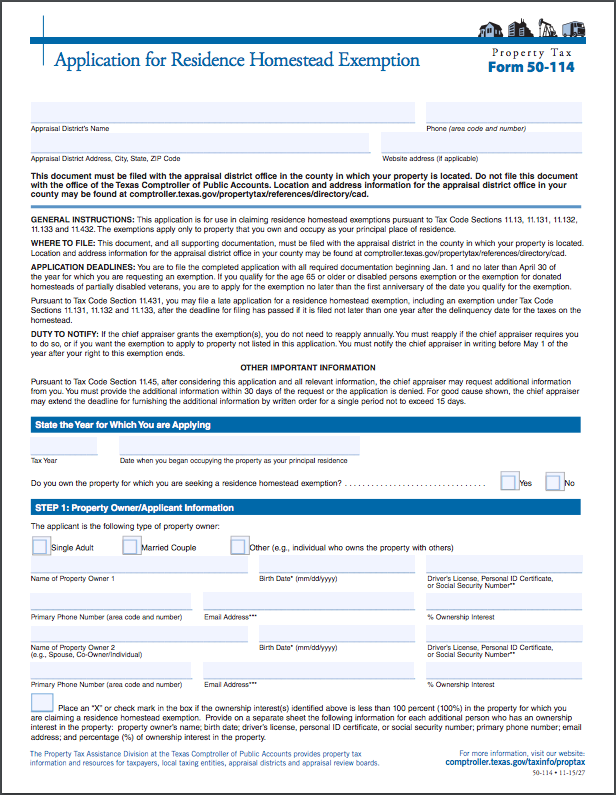

Homestead Exemptions & What You Need to Know — Rachael V. Peterson, The texas homestead exemption laws for 2024 saw some significant changes thanks to proposition 4, passed by voters in november 2023. A copy of your valid texas driver’s license showing the homestead address.

Source: www.dochub.com

Source: www.dochub.com

Homestead exemption form Fill out & sign online DocHub, In texas, it’s free to file for a homestead exemption. Homeowners can now get up to $100,000 off their home's value for school taxes, up from $40,000 before.

Source: www.har.com

Source: www.har.com

2022 Texas Homestead Exemption Law Update, (2024) in austin’s booming economy, property ownership definitely has its perks, e.g., paying fewer taxes in a place you call your home. Homeowners across the state are set to benefit from an increase in their homestead exemption from $40,000 to $100,000 of their home's assessed value.

Source: www.aiophotoz.com

Source: www.aiophotoz.com

2021 Declaration Of Homestead Form Fillable Printable Pdf And Forms, Homeowners across the state are set to benefit from an increase in their homestead exemption from $40,000 to $100,000 of their home's assessed value. A copy of your valid texas driver’s license showing the homestead address.

Source: www.exemptform.com

Source: www.exemptform.com

Hays County Homestead Exemption Form 2023, Applying for a homestead exemption in texas can be a beneficial step towards reducing your property taxes and protecting your primary residence. Other exemptions include those for military veterans, people with disabilities and homeowners over 65.

Source: www.exemptform.com

Source: www.exemptform.com

Harris County Homestead Exemption Form, 1751 enterprise athens, tx 75751. If passed by voters this fall, texas homestead exemptions will rise to $100,000, senior homeowners will be protected from being priced out of their home, the small business exemption for the franchise tax will double, and texas small businesses will be protected from excessive appraisal increases.

Source: nishadkhanlaw.com

Source: nishadkhanlaw.com

Homestead Exemptions In Florida Your Guide real estate lawyer Orlando, Texas driver's license or texas id card with the same address as the homestead property. Application for miscellaneous property tax exemption locked application for miscellaneous property tax exemption

Source: www.pinterest.com

Source: www.pinterest.com

Texas statewide Residence Homestead Exemption Form 50114. homestead, Dcad is pleased to provide this service to homeowners in dallas county. Houston texas buy a home sell a home.

![Travis County Homestead Exemption FAQs + How to File [2023]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-faq.jpg) Source: www.texasrealestatesource.com

Source: www.texasrealestatesource.com

Travis County Homestead Exemption FAQs + How to File [2023], The deal includes a major demand of the senate: General residence homestead exemption application for 2024.

Source: www.exemptform.com

Source: www.exemptform.com

How To Fill Out Homestead Exemption Form Bexar County Texas, Houston texas buy a home sell a home. The texas homestead exemption laws for 2024 saw some significant changes thanks to proposition 4, passed by voters in november 2023.

A Homestead Exemption Is An Exemption That Removes All Or A Portion Of Value From Your Residence Homestead As Authorized By The State Or Adopted By A Local Taxing Unit.

The deal includes a major demand of the senate:

This Means Cheaper Property Taxes, Making Homes More Attractive To Buy.

Other exemptions include those for military veterans, people with disabilities and homeowners over 65.